Is air cargo approaching a steep surge in demand?

Predictions are circulating that the next two decades will see a rapid increase in demand for air cargo – but this optimism may be overhyped, say experts.

The past few years have been a turbulent time for air cargo. After an extreme drop in capacity and spike in prices due to pandemic-related flight restrictions, last year air cargo demand bounced back, and now, aircraft maker Boeing is predicting a powerful uplift in both market share and fleets. Dr Robert Mayer, senior lecturer in air transport management at Cranfield University, points to the carrying of vaccines as a big stimulator of demand for air cargo, as well as the growth of e-commerce.

“In 2021 we definitely saw a kind of gold rush in air cargo, with many airlines focusing on this segment. We also saw the demand for new and converted freighter aircraft going up,” says Mayer. That increase in volume may be down to a rise in belly-hold capacity in passenger aircraft in markets such as China, which were heavily impacted by Covid, he adds. “Before the pandemic many of these routes provided significant belly-hold capacity for air cargo, which disappeared during the pandemic and, to some extent, had to be covered by freighter capacity,” says Mayer.

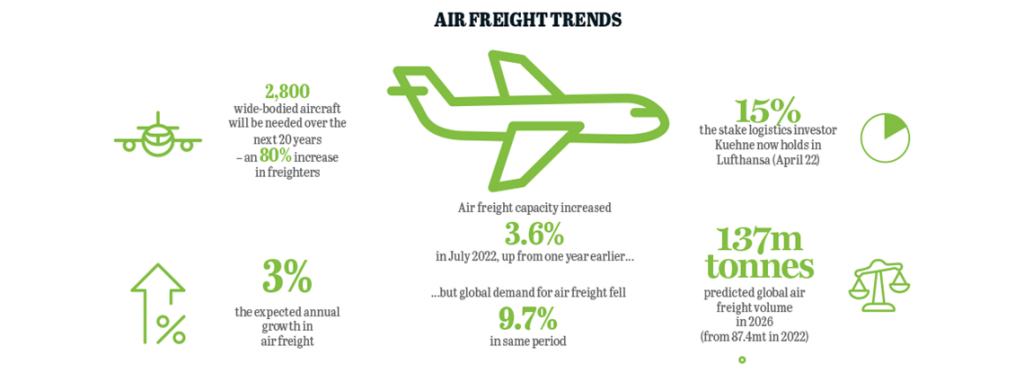

The expectation of cargo growth in the long term was primed further earlier this year, when Boeing said the industry would need an 80% increase in the number of wide-bodied aircraft – an extra 2,800 freighters including conversions from passenger planes – to meet demand over the next 20 years. Industry experts agreed – at least in part. Rico Merkert, professor in transport and supply chain management at the University of Sydney Business School and deputy director of the Institute of Transport and Logistics Studies, says while Boeing and its competitor Airbus are prone to deliver optimistic forecasts, there is a foundation for this confidence.

“I see strong growth of air freight of 3% a year. Boeing’s view, and Airbus, which predicts 3.2% CAGR, are good, assuming we only get a mild recession over the next couple of years,” he says. “The main reason for that is e-commerce. What gives me confidence in this is the investment currently going into air cargo, with [logistics billionaire] Kuehne acquiring 17.5% in Lufthansa, Maersk expanding its air cargo arm and MSC leasing aircraft from Atlas to develop its own air cargo solution.”

Market disruption

A further reason for the uptick in airfreight demand has come from outside of the industry, a knock-on effect from challenges to the maritime industry just as air cargo was recovering from a lack of capacity. Mayer says: “The problems we have witnessed in other sectors, such as port congestion and strikes, meant that air cargo still is relatively competitive relative to these other modes, even if demand for air cargo has been slightly dipping in comparison to pre-pandemic numbers.”

Certainly the cost of transport in other modes has been falling. In ocean transport, the Freightos Baltic Index ended at $6,414 on 15 July, down more than 40% from its all-time high of $11,109 in September 2021.

And the 29 September Drewry WCI composite index of $4,014 per 40ft container is now 61% below the peak of $10,377 reached in September 2021, though it still remains 8% above the five-year average. This scenario is also playing out in road freight, where the Coyote Logistics’ Coyote Curve shows spot market rates in June were down more than 22% from a year ago.

While the downward price trend is a positive change, it is also both precarious and unreliable. Consultancy Gartner points to the jeopardy potential of using global ports and inland congestion, plus labour actions currently affecting maritime – and therefore also road freight – as part of a tidal wave of wider disruptions from other factors such as high inflation, Covid-19 lockdowns and energy availability.

In that context, how are current air freight rates performing? In July the International Air Transport Association (IATA) data global air cargo data revealed an interesting picture. Global demand, measured in cargo tonne-kilometres (CTKs), fell 9.7% compared with July 2021 (-10.2% for international operations). Capacity was 3.6% above July 2021 (+6.8% for international operations), but still 7.8% below July 2019 levels, says the IATA.

And when it comes to the growth prediction, the association is cautious due to the range of issues influencing market behaviour. It says new export orders, a leading indicator of cargo demand, have decreased in all markets except China, which began a sharp upward trend in June. And the war in Ukraine continues to impair cargo capacity used to serve Europe as several airlines based in Russia and Ukraine were key players on the international scene.

But it also said global goods trade continued to recover in the second quarter of the year, and the easing of Covid-19 restrictions in China will support further recovery. While maritime will be the main beneficiary of these changes, air cargo will get a boost, says the IATA. “Air cargo is tracking at near 2019 levels although it has taken a step back compared to the extraordinary performance of 2020-2021.”

Brace for uncertainty ahead

Mayer believes the increasing inflation in many countries, which will eventually have an impact on consumption, may be a factor in determining demand for airfreight. He says that to some extent this can be witnessed by lower demand than expected for the new iPhone 14, reflected in Apple’s decision to limit production of the model to 90m handsets. “They are a good example of goods that are usually transported by air. Lower demand for these goods will negatively affect the demand for air cargo,” says Mayer.

It seems the long-term view of bullish air freight demand may be offset by the near and medium-term challenges posed by a host of macroeconomic and geopolitical issues.

Nevertheless, the uncertainty may provide opportunities for supply chain teams, says Gartner. In the current environment, Gartner recommends supply professionals prepare to capture the value from softening markets by addressing their existing contracts or by planning for new negotiations.

The firm urges specialists: “Recognise that long-term contract rates could already be above short-term spot market levels and challenge service providers to reduce pricing and share some of the benefits of declining prices. Reforecast transport capacity requirements, including changing the allocation of volume to carriers and service providers that are offering lower rates. Validate what, if any, service compromise may be required in terms of service levels.”

Wouter Dewulf, professor of air transport economics at the University of Antwerp and VP external of the Air Transport Research Society, is on the same page. He warns that prospects for air freight will ultimately be shaped by the cloud of uncertainty forming over the global economy. “As the world becomes more and more closed, we have more and more nearshoring in international trade. The recession will probably last a few years with the current rising inflation. In the past you could always catch up if it was a basic recession followed by growth. I’m not too sure that will happen,” says DeWulf.

Willie Walsh, director general at IATA, has a brighter outlook, though one of cautious optimism. He says: “Volatility resulting from supply chain constraints and evolving economic conditions has seen cargo markets essentially move sideways since April. July data shows us that air cargo continues to hold its own, but as is the case for almost all industries, we’ll need to carefully watch both economic and political developments over the coming months.”